Insights for legislators

Georgia Ag Impact Report

The Georgia Ag Impact Report provides the state's agricultural stakeholders the research-backed insights they need to support Georgia’s No. 1 industry. As a national leader in agricultural innovation and outreach, the University of Georgia College of Agricultural and Environmental Sciences (CAES) is proud to empower producers with innovative research to cultivate a stronger, healthier Georgia.

Insights for legislators

Georgia Ag Impact Report

The Georgia Ag Impact Report provides the state's agricultural stakeholders the research-backed insights they need to support Georgia’s No. 1 industry. As a national leader in agricultural innovation and outreach, the University of Georgia College of Agricultural and Environmental Sciences (CAES) is proud to empower producers with innovative research to cultivate a stronger, healthier Georgia.

The College of Agricultural and Environmental Sciences (CAES) is proud to share the Georgia Ag Impact Report, a report designed from our Ag Forecast data to provide an in-depth look at the opportunities and trends shaping Georgia’s agricultural sector.

Developed by the expert economists at CAES, this report offers valuable insights into the current and future landscape of agriculture in our state. It highlights the factors driving growth, as well as the areas where strategic investments can make a meaningful impact.

As key decision-makers and citizens of our great state, you play a critical role in shaping the future of agriculture in Georgia. This report provides the tools needed to make informed decisions that will benefit farmers, producers and the state’s economy as a whole. Together, we can work to ensure a bright future for agriculture in Georgia.

Sincerely,

Nick T. Place, PhD

Dean and Director

UGA College of Agricultural and Environmental Sciences

Economic outlook

The 2024 Georgia Farm Gate Value is $18,034,813,489.

The 2026 Georgia Ag Impact Report data is based on the 2024 Georgia Farm Gate Value Report, an annual county-level economic valuation for all food and fiber production in the state.

In 2024, food and fiber production and related industries contributed $100.4 billion in output to Georgia’s $1.5 trillion economy, as well as more than 370,400 jobs.

Key takeaways: Overall economic outlook

Source: Jeffrey M. Humphreys, director and senior public service associate at the UGA Selig Center for Economic Growth

- The 2026 forecast calls for the second straight year of slow economic growth.

- The trade war and restrictive immigration policies are the main problem.

- The risk of recession is high.

- The Federal Reserve will ease monetary policy.

- Gerogia will roughly match the United States' pace of GDP and job growth.

Key takeaways: Georgia agriculture economic outlook

Sources: Gopinath Munisamy, distinguished professor of agricultural marketing at the UGA Center for Agribusiness and Economic Development, and Ford Ramsey, associate professor in the UGA Department of Agricultural and Applied Economics

- The U.S. economy is expected to grow by roughly 2% in 2026, consistent with growth rates in the second half of 2025. Inflation rates are likely to continue to fall toward the Federal Reserve’s target inflation rate of 2%.

- The latest USDA projections indicate increased net cash farm income of $180.7 billion and net farm income of $179.8 billion in 2025. Rising receipts from animal products offset losses in crop receipts.

- Production expenses, both nominal and inflation-adjusted, are expected to have increased in 2025. Increased costs are largely a result of higher prices for feed, livestock/poultry inputs, and labor, while costs for chemical inputs and fuel fell slightly.

- Stagnant prices and increasing costs suggest a negative outlook for most of Georgia’s major crops in 2026. The outlook for animals and animal products is generally positive.

- Changes to farm programs in the One Big Beautiful Bill Act, and ad-hoc disaster assistance programs, will be important in keeping farmers afloat; many commodities will continue to experience a cost-price squeeze in 2026. In terms of agricultural policy moving forward, trade actions and immigration concerns will continue to lead to uncertainty in the economic outlook for U.S. and Georgia agriculture.

For more insights and key takeaways, please visit the 2026 Georgia Ag Forecast annual publication.

The Georgia Ag Forecast is an annual seminar hosted by CAES sharing the latest research and information from CAES faculty to help Georgia farmers and agribusinesses prepare for their year ahead.

Economic outlook

The 2024 Georgia Farm Gate Value is $18,034,813,489.

The 2026 Georgia Ag Impact Report data is based on the 2024 Georgia Farm Gate Value Report, an annual county-level economic valuation for all food and fiber production in the state.

In 2024, food and fiber production and related industries contributed $100.4 billion in output to Georgia’s $1.5 trillion economy, as well as more than 370,400 jobs.

Key takeaways: Overall economic outlook

Source: Jeffrey M. Humphreys, director and senior public service associate at the UGA Selig Center for Economic Growth

- The 2026 forecast calls for the second straight year of slow economic growth.

- The trade war and restrictive immigration policies are the main problem.

- The risk of recession is high.

- The Federal Reserve will ease monetary policy.

- Gerogia will roughly match the United States' pace of GDP and job growth.

Key takeaways: Georgia agriculture economic outlook

Sources: Gopinath Munisamy, distinguished professor of agricultural marketing at the UGA Center for Agribusiness and Economic Development, and Ford Ramsey, associate professor in the UGA Department of Agricultural and Applied Economics

- The U.S. economy is expected to grow by roughly 2% in 2026, consistent with growth rates in the second half of 2025. Inflation rates are likely to continue to fall toward the Federal Reserve’s target inflation rate of 2%.

- The latest USDA projections indicate increased net cash farm income of $180.7 billion and net farm income of $179.8 billion in 2025. Rising receipts from animal products offset losses in crop receipts.

- Production expenses, both nominal and inflation-adjusted, are expected to have increased in 2025. Increased costs are largely a result of higher prices for feed, livestock/poultry inputs, and labor, while costs for chemical inputs and fuel fell slightly.

- Stagnant prices and increasing costs suggest a negative outlook for most of Georgia’s major crops in 2026. The outlook for animals and animal products is generally positive.

- Changes to farm programs in the One Big Beautiful Bill Act, and ad-hoc disaster assistance programs, will be important in keeping farmers afloat; many commodities will continue to experience a cost-price squeeze in 2026. In terms of agricultural policy moving forward, trade actions and immigration concerns will continue to lead to uncertainty in the economic outlook for U.S. and Georgia agriculture.

For more insights and key takeaways, please visit the 2026 Georgia Ag Forecast annual publication.

The Georgia Ag Forecast is an annual seminar hosted by CAES sharing the latest research and information from CAES faculty to help Georgia farmers and agribusinesses prepare for their year ahead.

View data by year, county or commodity

The Georgia Farm Gate Value Report is an annual, county-level economic valuation of food and fiber production in the state. The numbers in this report are estimated by local county UGA Cooperative Extension agents and refined by data analysts from the CAES Department of Agricultural and Applied Economics. This report was last reviewed January 2025.

For best functionality, view on desktop. To expand this visualization, select the full-screen icon in the bottom right corner. Click the three dots icon on mobile.

Top 10 commodities:

1. Broilers: $6.1 billion | 36.1% of total farm gate value

2. Beef: $1.2 billion | 6.9% of total farm gate value

3. Eggs: $1 billion | 6.1% of total farm gate value

4. Peanuts: $877.9 million | 5.2% of total farm gate value

5. Greenhouse: $863.2 million | 5.1% of total farm gate value

6. Cotton: $770.4 million | 4.6% of total farm gate value

7. Timber: $655.6 million | 3.9% of total farm gate value

8. Dairy: $469.3 million | 2.8% of total farm gate value

9. Corn: $382.8 million | 2.3% of total farm gate value

10. Blueberries: $382.7 million | 2.3% of total farm gate value

Top 10 vegetables:

- Watermelons: $220.6 million | 1.2% of the total farm gate value

- Onions: $194.3 million | 1.1% of the total farm gate value

- Bell peppers: $179.8 million | 1% of the total farm gate value

- Sweet corn: $179.1 million | 1% of the total farm gate value

- Cucumbers: $117.6 million | .6% of the total farm gate value

- Tomatoes: $99 million | .5% of the total farm gate value

- Greenhouse: $67.5 million | .4%of the total farm gate value

- Broccoli: $46.9 million | .3%of the total farm gate value

- Yellow squash: $42.1 million | .2% of the total farm gate value

- Cabbage: $36.1 million | .2% of the total farm gate value

Commodity-specific insights

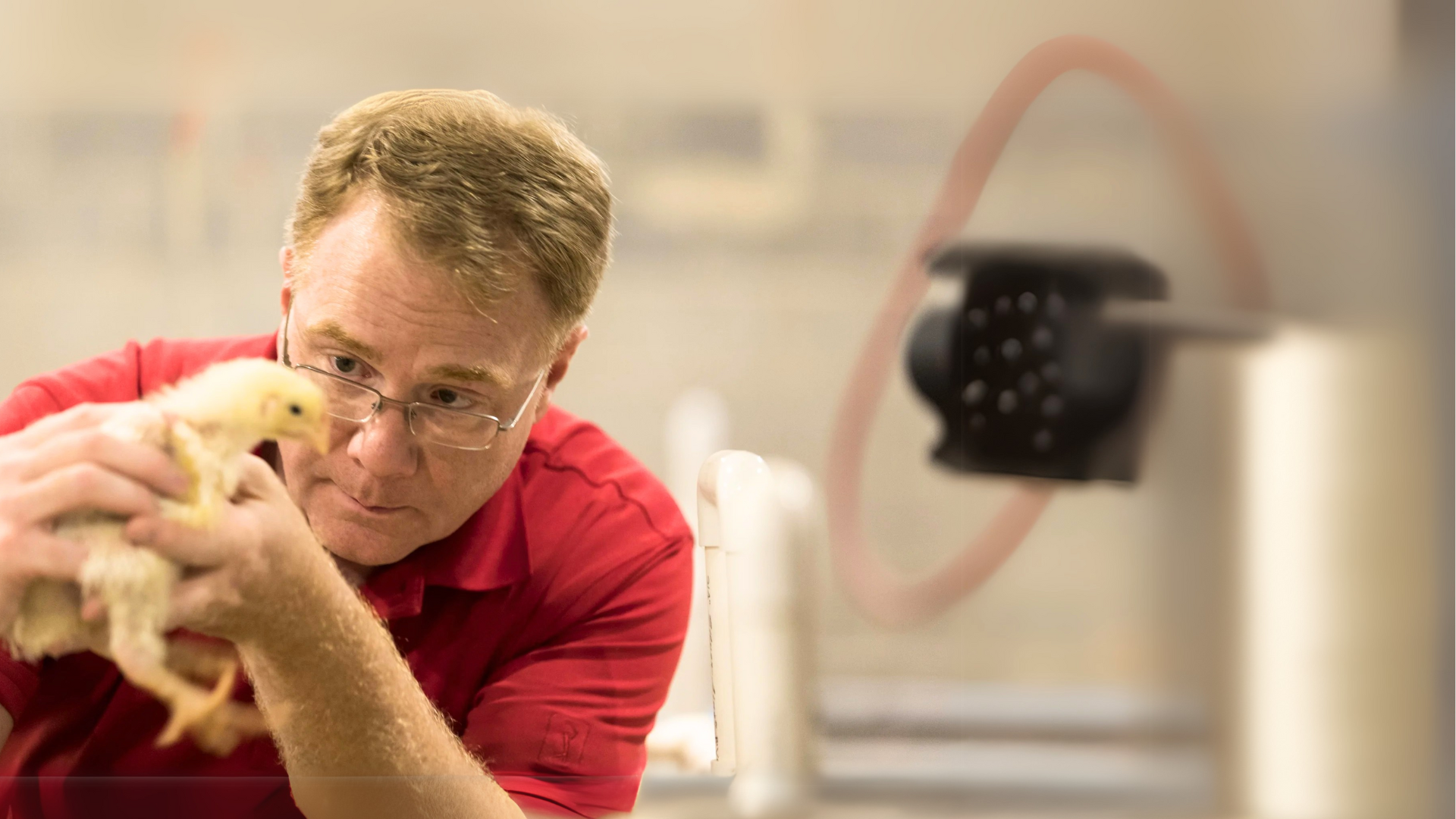

Poultry and eggs

Poultry and eggs contributed $33.2 billion to the statewide economy and represented 84,255 jobs in Georgia. Nearly 73% of Georgia counties are involved in poultry and egg production.

Distribution:

- Broilers: 84.2%

- Hatching and table eggs: 14.2%

- Pullets: 1.6%

- Quail and miscellaneous: .1%

Top county producers:

- Hart: $562,522,438 | 3.12% of the total farm gate value

- Franklin: $543,859,150 | 3.02% of the total farm gate value

- Madison: $389,798,947 | 2.16% of the total farm gate value

Row and forage crops

Row and forage crops contributed $12.6 billion to the statewide economy and represented 44,857 jobs in Georgia. In 2023, Georgia produced half of the nation's peanuts.

Distribution:

- Peanuts: 31.2%

- Cotton: 27.4%

- Corn: 13.6%

- Hay: 12.6%

- Soybeans: 4.6%

Top county producers:

- Mitchell: $206,500,146 | 1.15% of the total farm gate value

- Decatur: $103,728,714 | .58% of the total farm gate value

- Dooly: $88,661,452 | .49% of the total farm gate value

Livestock and aquaculture

Livestock and aquaculture contributed $11.1 billion to the statewide economy and represented 37,747 jobs in Georgia. Beef ranked No. 2 among commodities listed in the 2024 Georgia Farm Gate Value Report.

Distribution:

- Beef cows: 44.1%

- Dairy: 22.1%

- Horses: 13.7%

- Beef stockers: 6.4%

- Beef cattle finished outside county: 4%

Top county producers:

- Macon: $114,849,688 | .64% of the total farm gate value

- Burke: $102,812,518 | .57% of the total farm gate value

- Brooks: $84,398,946 | .47% of the total farm gate value

Ornamental horticulture

Ornamental horticulture contributed $11.8 billion to the statewide economy and represented 75,969 jobs in Georgia. Ornamental horticulture is ranked the No. 4 commodity group in Georgia by farm gate value.

Distribution:

- Greenhouse: 51.1%

- Turfgrass: 18.3%

- Field nursery: 14.1%

- Container nursery: 13.7%

- Other: 2.7%

Top county producers:

- Gwinnett: $113,550,000 | .63% of the total farm gate value

- Columbia: $113,204,350 | .63% of the total farm gate value

- Franklin: $80,574,042 | .47% of the total farm gate value

Vegetables

Vegetables contributed $3.1 billion to the statewide economy and represented 12,825 jobs in Georgia. Vegetables are ranked No. 5 commodity group in Georgia by farm gate value.

Distribution:

- Watermelons: 15.3%

- Onions: 13.5%

- Bell peppers: 12.5%

- Sweet corn: 12.5%

- Cucumbers: 8.2%

Top county producers:

- Colquitt: $242,362,860 | 1.34% of the total farm gate value

- Echols: $116,691,000 | .65% of the total farm gate value

- Decatur: $109,218,350 | .61% of the total farm gate value

Fruits and nuts

Fruits and nuts contributed $3 billion to the statewide economy and represented 12,369 jobs in Georgia.

Distribution:

- Blueberries: 39.8%

- Pecans: 28.5%

- Peaches: 13%

- Grapes: 5.7%

- Citrus: 3.3%

Top county producers:

- Bacon: $118,574,000 | .66% of the total farm gate value

- Mitchell: $50,547,000 | .28% of the total farm gate value

- Pierce: $46,789,535 | .26% of the total farm gate value

Forestry and products

Forestry and products contributed $9.4 billion to the statewide economy and represented 40,360 jobs in Georgia. Timber was the No. 7 ranked individual commodity in the 2024 Georgia Farm Gate Value Report.

Distribution:

- Timber: 77.1%

- Pine straw: 11.1%

- Other forestry: 11.3%

- Christmas trees: .6%

Top county producers:

- Wayne: $32,967,674 | .18% of the total farm gate value

- Emanuel: $27,873,103 | .15% of the total farm gate value

- Washington: $27,788,351 | .15% of the total farm gate value

Agritourism and hunting leases

Agritourism and hunting leases contributed $2 billion to the statewide economy and represented 17,766 jobs in Georgia.

Distribution:

- Hunting leases for deer: 31.3%

- Guide services: 13.3%

- Camping: 13%

- Hunting leases for turkey: 9.9%

- Special attractions: 9.5%

Top county producers:

- Gilmer: $8,159,500 | .05% of the total farm gate value

- Toombs: $7,500,000 | .04% of the total farm gate value

- Cherokee: $6,630,000 | .04% of the total farm gate value

County- and district-level data

|

2024 top 10 counties by total farm gate value |

||

|---|---|---|

|

County |

Total farm gate value |

Percentage of total |

|

Colquitt |

$700,072,087.73 |

3.88% |

|

Hart |

$665,747,097.90 |

3.69% |

|

Franklin |

$661,710,718.25 |

3.67% |

|

Mitchell |

$554,013,243.92 |

3.07% |

|

Tattnall |

$500,015,506.10 |

2.77% |

|

Madison |

$445,722,560.90 |

2.47% |

|

Macon |

$426,069,810.71 |

2.36% |

|

Gordon |

$383,543,024.90 |

2.13% |

|

Oglethorpe |

$376,632,308.80 |

2.09% |

|

Coffee |

$338,406,889.03 |

1.88% |

|

2024 total farm gate value by Cooperative Extension district |

||

|---|---|---|

|

District |

Total farm gate value |

Percentage of total |

|

Northeast |

$5,346,844,447.05 |

29.65% |

|

Northwest |

$2,562,838,041.17 |

14.21% |

|

Southeast |

$3,778,573,326.88 |

20.95% |

|

Southwest |

$6,346,557,673.70 |

35.19% |

Agriculture supports many other Georgia industries.

In terms of employment:

- Truck transportation: 6,045 employed

- Other nondurable goods wholesalers: 4,739 employed

- Management of companies and enterprises: 3,973 employed

- Grocery and related product wholesales: 3,054 employed

- Employment services: 2,835 employed

- Other durable goods merchant wholesales: 2,371 employed

- Scenic and sightseeing transportation and support activities: 1,913 employed

- Insurance agencies, brokerages and related activities: 1,550 employed

- Couriers and messengers: 1,272 employed

- Rail transporation: 1,243 employed

Together, Georgia commodities directly represent a value of over $18 billion to the state's economy. This figure is increased from $17.6 billion in 2023.

In 2024, food and fiber production and related industries contributed $100.4 billion in output to Georgia’s $1.5 trillion economy, as well as more than 370,400 jobs.

The University of Georgia's College of Agricultural and Environmental (CAES) serves Georgians by showcasing and communicating the most up-to-date and relevant agricultural and economic information for Georgia's No. 1 industry: agriculture.

As Georgia's land-grant university, CAES conducts cutting-edge research on critical and emerging issues that are important to the agriculture industry. From this research, CAES provides the best information and education available to producers and constituents to equip them with knowledge and decision-making tools for their businesses.

We need your continued support so Georgia can continue to be a leader in agriculture and environmental sciences to create a healthier and more prosperous Georgia.